Page explanations

The following sections explain each page on the website: its purpose and how to use it. These pages are the ones you'll need to know how to use in order to obtain a sell or hold recommendation.

You're free account will auto-register once you login.

Why we use social media

Typically you'd sign up to a new website like Sell or Hold by providing an email address and optionally entering a password. That website might send you an email to confirm you're the owner of that email address and to complete the registration process. You would need to remember which email address you provided and what password you set.

Each time you create an account with a new website, you need to remember a password and the email address you used to register. Each website needs to handle storage and authentication of your credentials.

But some websites already handle this really well. Why not leverage from their effort and reduce the number of passwords you have to remember?

How to register

The Sell-or-Hold website requires you

to have an account with one of the popular social media. You register with Sell-or-Hold via your chosen social media. Instead of remembering another password, all you need to remember is which social media you chose when registering with Sell-or-Hold. If you can login to that social media, then

you can login to the Sell-or-Hold website too.

If you do not have an account with one of the social media we have available, you'll have to create an account with them first.

How to login

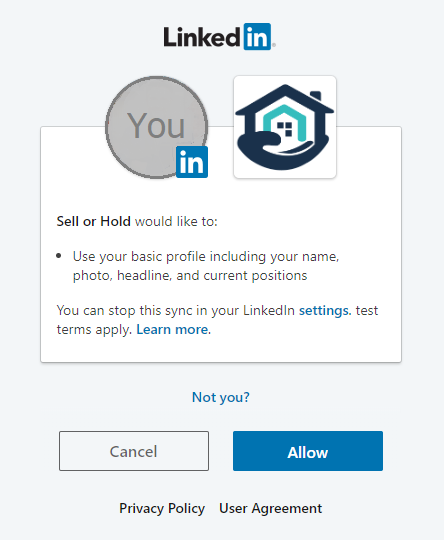

To login to Sell-or-Hold you simply click on the appropriate social media icon to commence the login procedure.

The social media you selected will present a login dialogue for you to enter your credentials. Following is an example of Linked In's login dialogue...

Remember which social media you used to sign-up. It will make login to Sell-or-Hold a lot easier.

If you do not have an account with any of the social media listed, you will need to create an account with one of them in order to login.

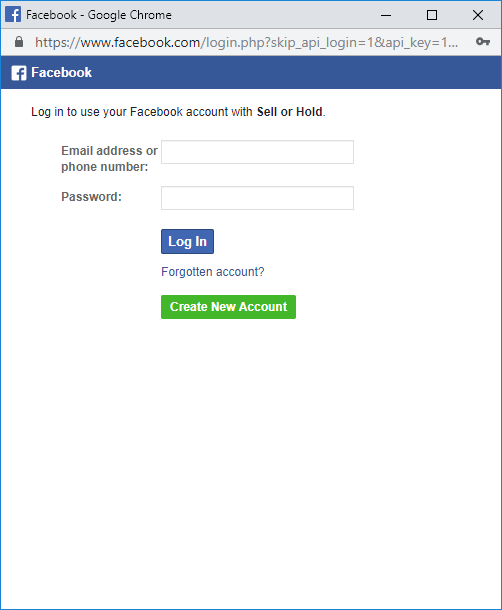

If you have an account with one of the social media listed, click on the matching icon for that social media. Once you click on a social media icon, you will be presented with that social media's "login" dialogue. Following is an example of Face Book's login dialogue...

Note that the Sell-or-Hold website does not know your social media password. It simply asks your chosen social media to verify who you are and to provide your email address so you can be contacted. The social media you select will "authenticate" who you are. Sell-or-Hold does not do this.

Multiple accounts

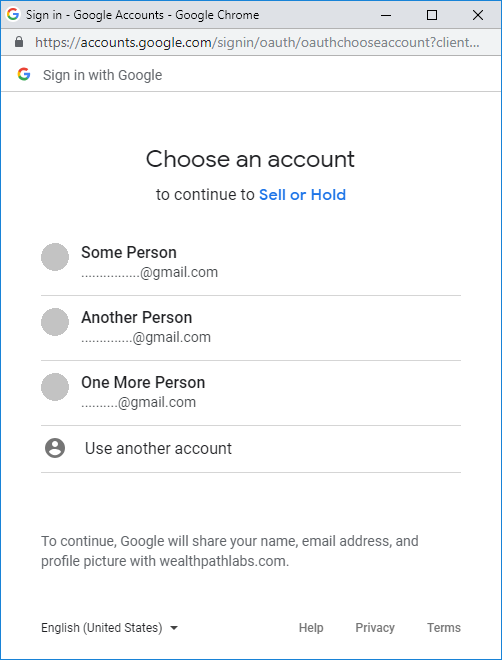

You don't need to login using the same social media every time, you can use another. But they must have the same email address or Sell-or-Hold will create a new account. Sell-or-Hold creates a new account for each unique email address you login with. So long as each social media you use has the same email address, it won't matter which one you use.

If you use a different social media and they have a different email address on their records, Sell-or-Hold will create a fresh account as soon as you login to Sell-or-Hold via that social media. Any properties you added for analysis in your previous Sell-or-Hold account will not appear in your new account.

It's best to login to Sell-or-Hold using the same social media every time.

You may have multiple accounts with the same social media. The following image shows multiple accounts with Google.

Remember which account you used to login. If after logging in you notice that you have an empty property list, you’ve probably logged in using the wrong social media account. Log out and login again using a different account.

Remove Sell or Hold from your social media

When you connect to Sell or Hold via a social media, that social media keeps a record of your selection. Next time you come to Sell or Hold to sign-in, the sign-in procedure becomes very easy.

However, you may want to sign-in using a different account of the same social media. For example you may have two Facebook accounts and you want to login using the other one.

You can remove Sell or Hold from your social media. This will make your social media forget about Sell or Hold. Sell or Hold will appear new to your social media next time you try to sign-in.

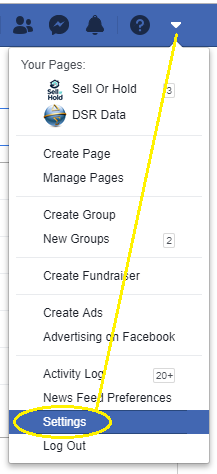

The following images show how to remove the Sell or Hold app from Facebook. The first thing you must do is go to Facebook and login. Then click on the black down arrow...

Then select 'Settings' from the drop down...

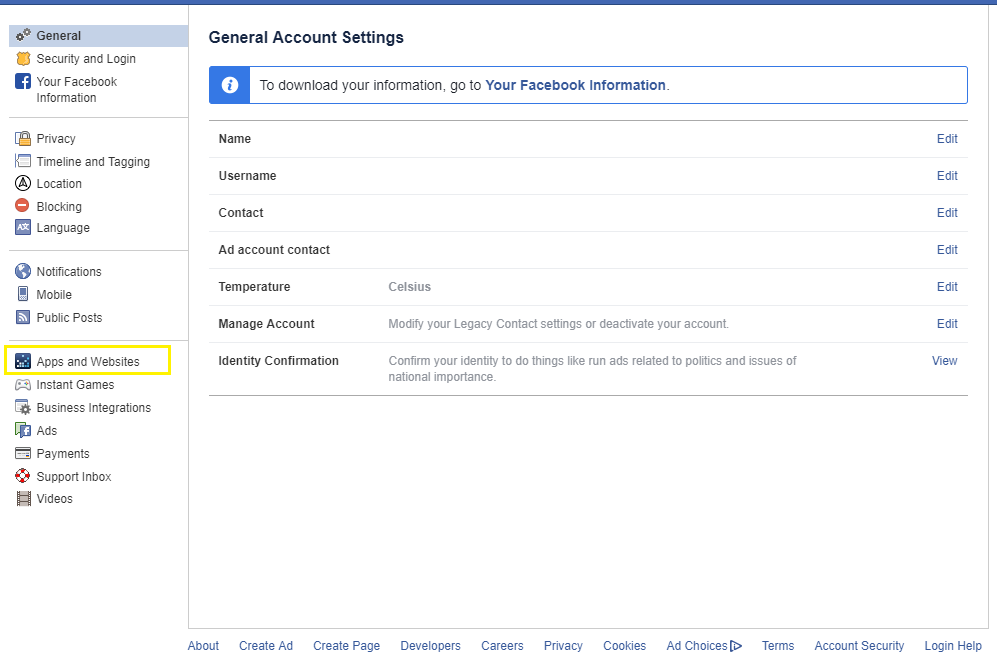

You'll see the 'Settings' page...

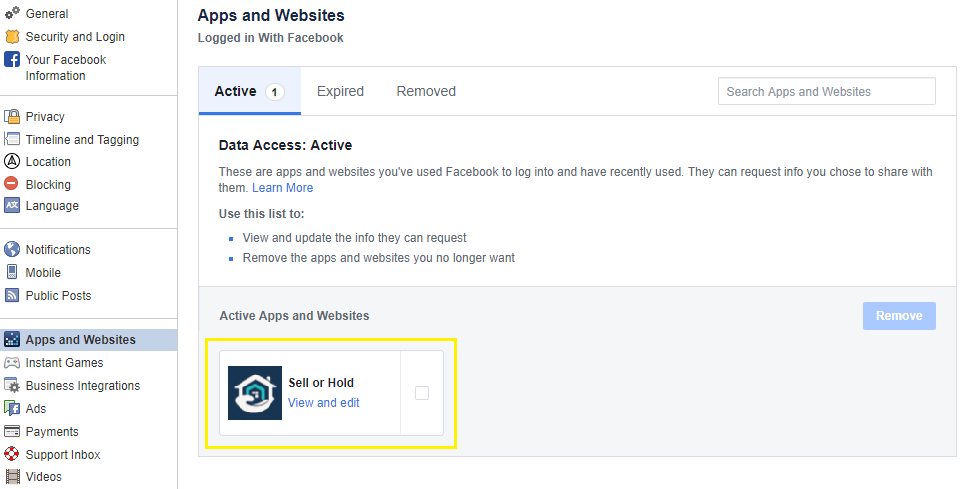

Click on the 'Apps & websites' link to the left and you'll see a list of apps...

Find the Sell or Hold app and click on the 'View and Edit' link...

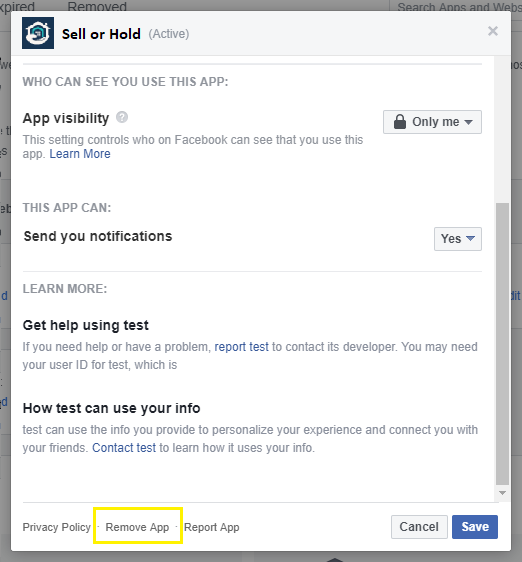

Select 'Remove App' from the bottom of the dialogue.

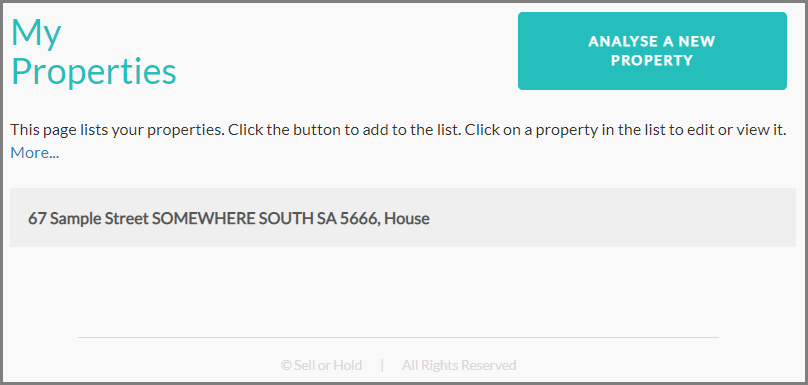

This page lists all your properties and allows you to add new ones or edit existing ones.

List of properties

Initially, the list of properties you're analysing will be empty. The first thing you need to do is add a property to the list to be analysed.

Analyse a new property

There is a button you must click on to add a new property to the list...

Clicking on this button will open the "Check Market" page for you to select the market in which your property resides. A check of this market is made to ensure there is adequate data before you can proceed.

Once your property's market has been successfully checked, you'll be able to edit details for your property using the "Property Details" page. And whenever you return to the My Properties page, your property will appear in the list.

View/edit property

Once you've added a property to the list you can view or edit its details any time. Click on the property you want to view or edit. Clicking on the property will open the "Property Details" page for you to view or edit details about the property you're analysing.

This page asks you to identify your property by entering its address, picking its suburb and choosing its type.

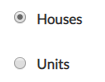

Property type

Firstly, you will need to select the property type that most likely matches your investment property. Radio buttons will appear like in the following image...

We consider a Villa or Terrace as a House. A Townhouse is considered a House if it has 3 or more bedrooms, otherwise it is considered to be a unit.

If you’re not sure whether to pick House or Unit, use the bedroom count as a gauge. However, if you have a 3-bedroom unit and it’s definitely a unit, then select the Unit option. Similarly, if you have a 2-bedroom house and it’s definitely a house, then select the House option.

Only if it’s unclear whether it is a house or a unit should the bedroom count be considered.

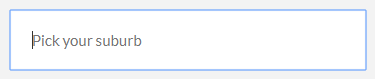

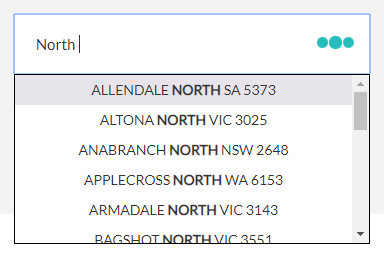

Suburb

There is also a field for you to select the suburb in which your current investment property resides...

Start typing the name of the suburb or its postcode. After you've entered a few characters, the field will show a list of suburbs that contain the text you've entered.

If your suburb doesn't appear in the list, you may need to type more letters of the suburb's name. If the list is empty, check the spelling of the suburb.

Note that some organisations may refer to your suburb as "Somewhere South" or as "South Somewhere". Try moving the compass prefix to a suffix or vice-versa. Also, note that some suburbs have hyphens where spaces might be expected e.g. "BRIGHTON-LE-SANDS".

When you see your suburb in the list, select it. Be careful not to select a similarly named suburb e.g. "BOX HILL" and "BOX HILL SOUTH". Also, check the post code. Suburb names are not unique within a state. For example, there are 3 suburbs called "KINGSWOOD" in NSW.

Street Address

There is also a field for you to enter the street address of your current investment property that is to be analysed.

You don’t have to enter the street address of your property if you don’t wish to. You could enter a nickname instead if you prefer.

However, if you have a large portfolio of properties to analyse, you’ll want to be able to easily distinguish between them. The street address might be the best method, but any unique set of letters and numbers will do.

Proceed

Once the market has been entered and payment has been made, it cannot be changed. All analysis will

be based on market data for the suburb and property type specified here. So, check it is correct.

Once you’ve entered a street addre

ss and selected the appropriate suburb and property type, you are then ready to check if this market has sufficient information. Click on the ‘Proceed’ button.

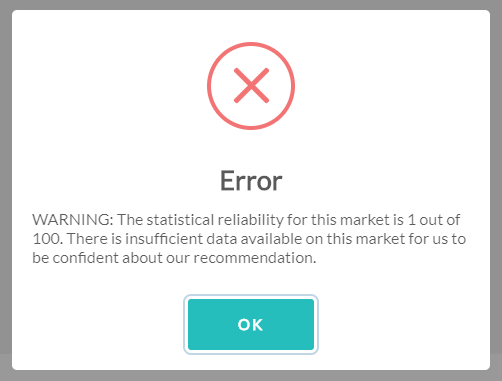

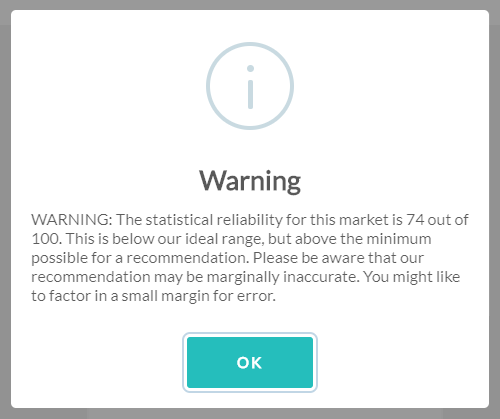

Confirmation pop-ups

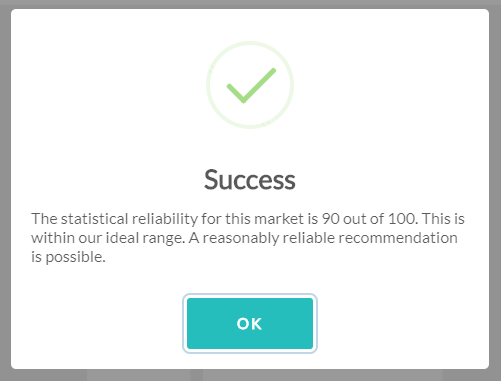

After clicking on the proceed button, you will see one of the following pop-up messages:

This means you cannot continue. There is insufficient information to perform a reasonably reliable recommendation. Unfortunately, you will need to decide about this property using alternative methods.

This means there is sufficient data available concerning your current investment property’s market. However, the data is less than ideal. The recommendation report provided may not be reliable, but you can continue if you wish to. If you choose to continue, you should definitely follow up the recommendation with some additional research.

This means the data for this property market is reliable. The recommendation report should therefore also be reasonably reliable.

This page allows you to enter details about the property and your circumstances.

The page shows which property is being analysed in the title.

Fields are provided for you to enter details about your property. Most of the details require dollar values to be entered, but some are percentages.

Sections

Since there are many fields, they are grouped into sections to make finding them easier. Each section can be collapsed to hide the fields within it by clicking on the "collapse" icon to the left of the field's label.

When you collapse a section, the fields within it disappear and the "collapse" icon changes to an "expand" icon. You can click on the "expand" icon to make the fields re-appear.

Information icons

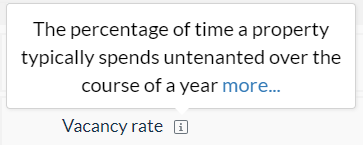

Each field appears on a single row. Each row contains a label for the field and an information icon.

You can see a quick explanation of a field if you click on its information icon. A click on an information icon will pop-up a brief explanation.

Each explanation pop-up contains a link to view even more information about that field. All the fields are explained on the Field Explanation page.

Errors and warnings

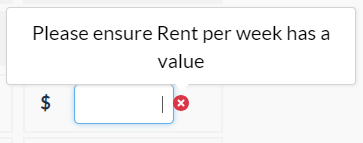

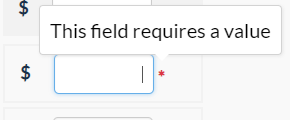

If there are any errors with the values you enter in a field, the field will be marked with an error icon.

If you click on the error icon, a pop-up will appear showing the error message.

Some fields will have a small red asterisk next to them. This marks the field as mandatory, meaning you must enter a value.

Don’t worry too much about the required fields and error icons that will appear next to many fields when you’re just starting out. Many of them are calculated fields dependent on other fields having values. As you enter more data, more of these error icons and red asterisks will disappear.

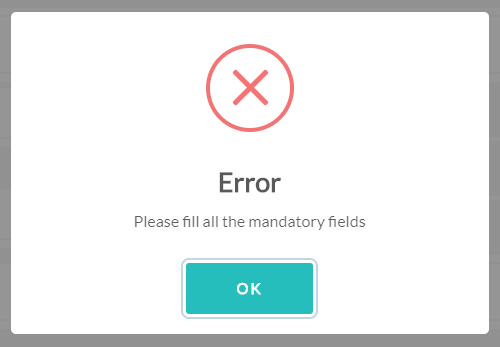

In order to proceed to the next step in your analysis of your property, you will need to “resolve” all errors. This means entering values in such a way that there are no more fields with error messages.

Some fields may display a warning icon instead of an error icon.

The warning icon behaves the same as the error icon with one important difference. You do not need to “resolve” all warnings. You can choose to ignore them. They serve a useful purpose however. It’s possible you may have mistakenly entered a value. The value could be too small or too large for what is considered normal. The warning messages give you a “heads-up” to a potential typo.

Saving

The Property Details page auto-saves. Each time you make a change and move to another field, the last change is saved. This means you don’t have to keep clicking on a Save button.

Read-only fields

Some of the fields are read-only, they appear with a grey background.

You cannot modify the value in these fields. These fields will instead have their values automatically calculated.

Back button

You can go back to view your list of properties on the "My Properties" page by clicking on this button...

Your changes will be saved automatically. You can come back to edit a property's details at any time.

Next button

If you have resolved all errors, you will be allowed to proceed to the next page. You can do this by clicking on this button...

If there are outstanding errors, these will be displayed.

If there are no outstanding errors, you will be allowed to proceed to the next step in the process, the "Alternatives" page.

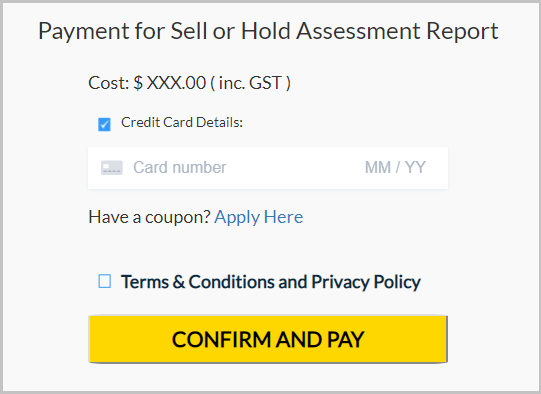

You need to pay to use certain features of Sell-or-Hold. This page allows you to make payment.

The payment page shows the amount you must pay to continue with the Sell-or-Hold service. Investors are strongly encouraged to view a sample recommendation report before proceeding to pay. See the Pricing Page for details.

Data

All

market data used in the analysis and reports will be based on data available as at the time of payment. This will be no more than a month old as at the time of payment. Note that the data will not be updated each new month after payment has been made. You have the market data as at the date of

payment only. It should be still relevant for at least a couple of months after payment.

Terms and Conditions

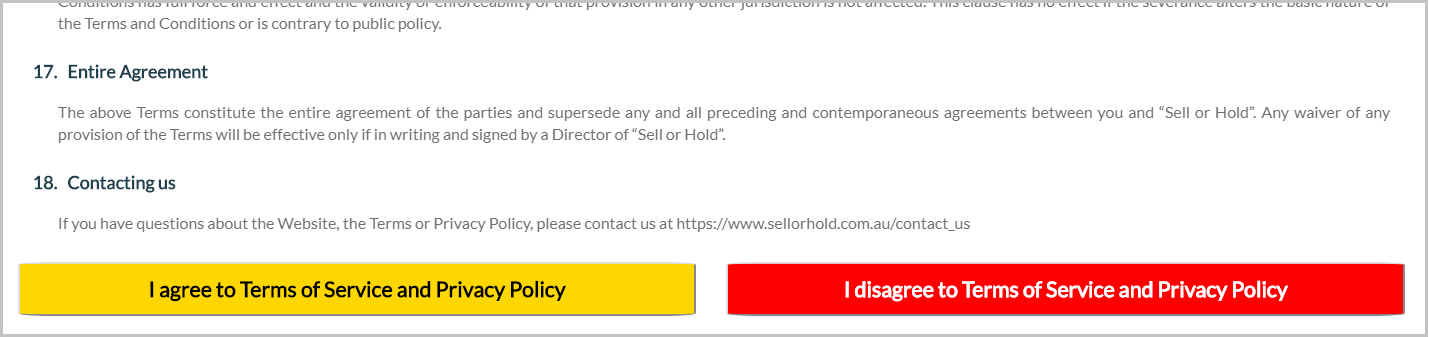

You will need to review and accept terms and conditions of use before being allowed to proceed.

Click on the button to view the terms and conditions. A pop-up will appear. There should be a confirmation button at the bottom.

Once you’ve accepted the terms and conditions and made payment, you’ll be allowed to proceed.

This page allows you to pick from alternative markets that might be better than your current one. You can choose markets that have better yield, lower risk, leave more spare funds in your pocket after settlement, etc.

The Alternatives page shows the extraordinary power of the Sell-or-Hold algorithm and its extensive database. A large number of details have been considered to provide tremendous flexibility so recommendations will suit a wide range of investors.

But power and flexibility come with increased complexity. The following explanation is a lot to read through. But an understanding of this page is crucial to helping you realise your options and put your equity to work at its full potential.

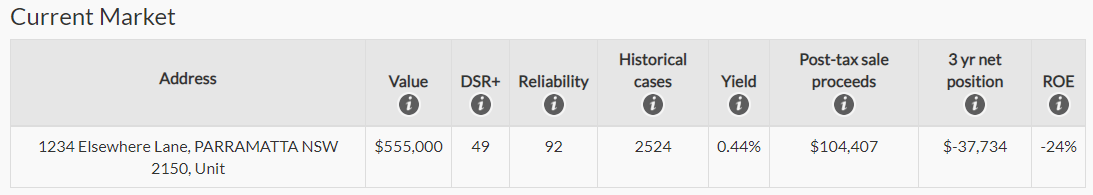

Current Market

At the top of the page is a table showing some key market details for your existing investment property. It appears in a table called the ‘Current Market’ table.

Each column in this table has an information icon in the column heading. Click on the information icon to see an explanation of the column’s data.

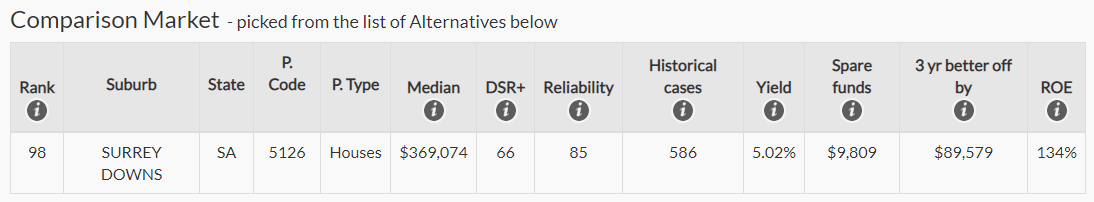

Comparison Market

Before the Sell-or-Hold analysis can be completed and a recommendation report generated, a “comparison market” is needed. This is a potential replacement market for your existing property. It will be compared against your current property to see if recycling equity will result in a better net position in the near future.

You can click on the column information icons to understand the data presented in each column.

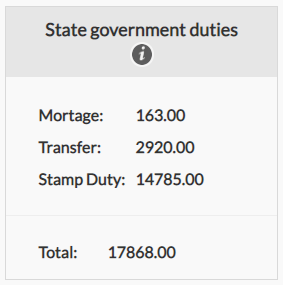

State government fees and duties

There is also a table of state entry fees such as stamp duty. These would have to be paid to the land authority for the state the comparison market is in.

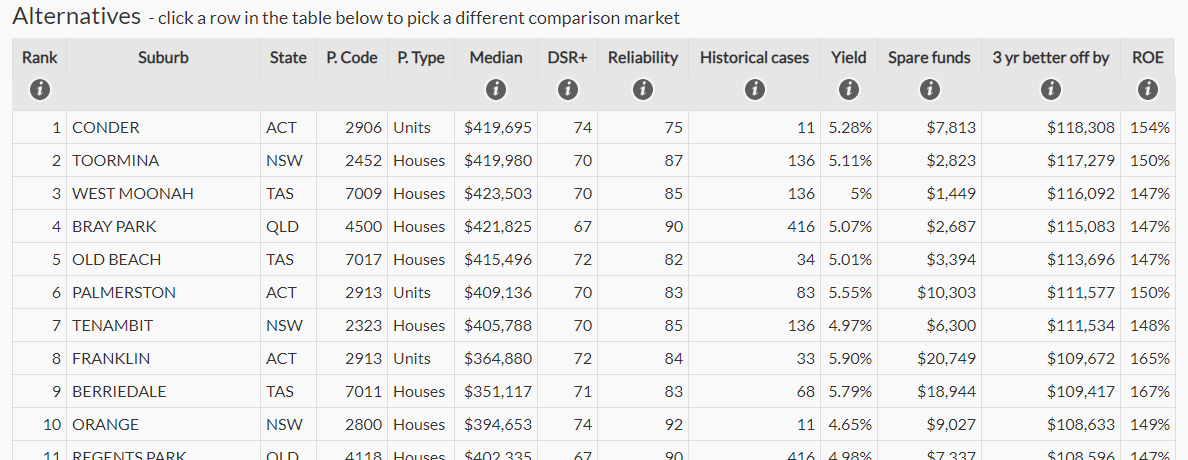

Alternative markets

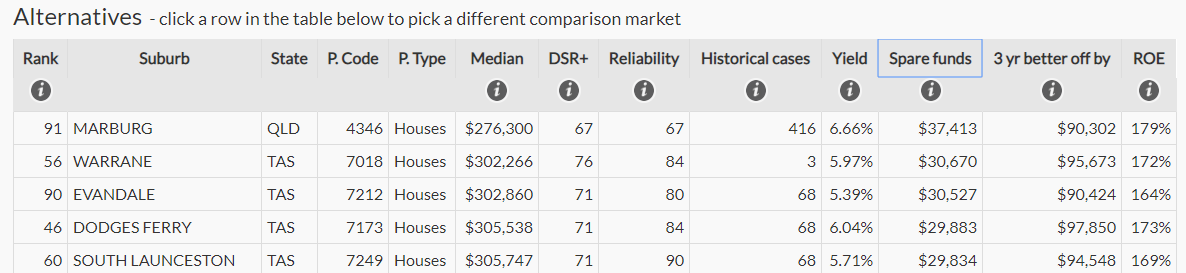

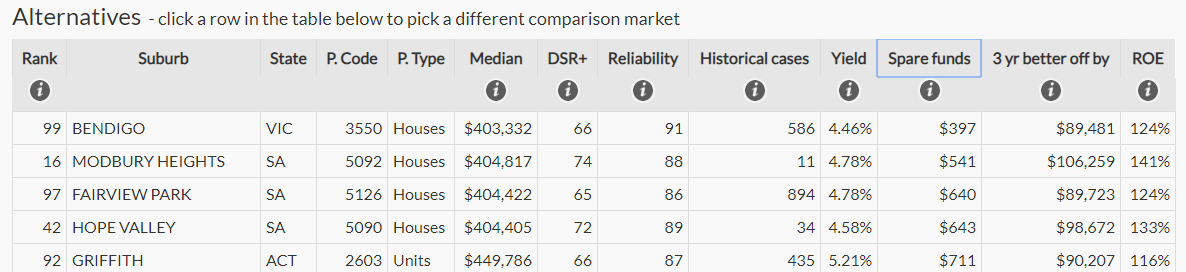

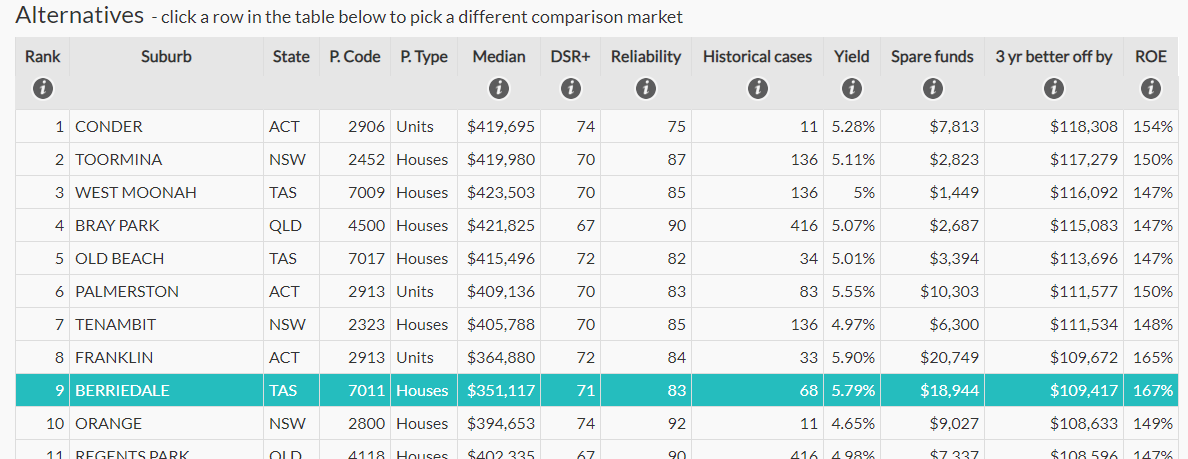

The last table shows a list of alternative markets. One of these could contain a replacement property for your existing property. One of them must be selected before an assessment report can be generated.

These markets have been chosen because they have all of the following essential characteristics:

• A median close to the target price range (which was based on a sale proceeds estimate)

• High potential for immediate growth according to the demand to supply ratio (DSR+)

• Sufficient statistical reliability for us to calculate a reliable DSR+

• A positive net position after 3 years

A market must be chosen from this list. It will be called the “comparison market” because it will be compared with your existing market. The comparison market is not a recommendation, it is simply used to perform a comparison. Some details of the comparison market appear in the “Comparison Table”.

If the comparison market is forecast to perform far better than your existing market, there’s a good chance the Assessment Report will suggest you sell your existing property and buy into the comparison market or a better market. If the comparison market won’t perform significantly better than your existing property’s market, the report will probably suggest you to hold on to your current property.

How to choose a comparison market

Before you can proceed to the next step, which is to generate an assessment report, you'll need to choose a comparison market from the list of Alternative markets. When you generate an assessment report, the report will compare your current property and the state of its market with the market you've chosen as a potential replacement for your current investment property - the alternative.

Since each investor may be at a different stage in their life, they may have a different performance requirement or risk tolerance. This part of your analysis allows you to specify what your preferences are. Sell or Hold provides a range of the most suitable property markets that could contain your replacement property. But it is up to you to choose which specific market from this list would be your preferred one.

For example, if you're nearing retirement, you may be more interested in a high yielding property market rather than a high growth market. Or you may prefer to have more spare funds available after purchase: either as a safety buffer; or to perform renovations.

Sorting the rows helps you prioritise which property markets are more important for you.

Sorting

The list of alternative markets is sorted by the “3 year better off by” column from highest to lowest. This is the default sorting. You can change the sort order by clicking on the column header at the top of the table. If you want to sort by “Spare funds”, click on that column heading.

Each click on the column heading will sort in one direction. It might be from lowest to highest, for example. Every subsequent click will reverse the sort order, for example, from highest to lowest.

Selecting a comparison market

Click on the row in the table of Alternative markets to select a comparison market. You can change your mind later and generate a new report using a different comparison market.

Property details

At the bottom of the page to the left is a BACK button you can click to return to the Property Details page.

Generating a Recommendation Report

At the bottom of the page to the right is a NEXT button you can click to generate a Recommendation Report.

The report will open in a new browser tab or window. The report will compare your existing investment property with the comparison market to see which is best, by how much and why.

The assessment report compares the existing investment property to the Comparison Market and makes a suggestion based on the recycling cost estimates and opportunity cost forecasts.

The report is opened from the NEXT button on the Alternatives page. It opens in a new browser tab or window to allow multiple reports to be compared side-by-side.

The report will contain a breakdown of:

• Growth, rent and expense forecasts

• Calculated recycle costs including exit costs and entry costs

• Opportunity costs

• A list of suitable alternative markets

• Market metrics of the current investment property’s market

• Market metrics of the comparison market

• The recommendation of how best to proceed and why

Investors are strongly encouraged to view a sample report before proceeding to pay.

The report’s content adapts according to the case of the investor and the property under examination. There are 3 different report types:

1. Recycle or hold

2. No alternative markets

3. Negative sale proceeds

Recycle or Hold Report

The recycle or hold report is the most common. It analyses the case of holding an investment property vs. selling it and investing the sale proceeds in an alternative.

The report considers the costs of exiting and re-entering the market and compares these with the opportunity costs of not investing in an alternative market. If the opportunity costs exceed the recycling costs by a significant margin, a “sell” suggestion is more likely.

No alternative markets Report

The “No Alternative Markets” report handles the special case where there are no markets in Australia that have all of the following qualities:

• Have median values within range of the sale proceeds estimated to be released if the current investment property was sold

• Have sufficient statistical reliability to gauge the level of supply and demand with a reasonable degree of accuracy

• Have a forecast net position (growth minus expenses plus rent) after 3 years that is more than zero

• Have an acceptable demand to supply ratio (DSR+)

The usual cause for this report being presented rather than the Recycle or hold report is insufficient sale proceeds. If the sale proceeds are too small, it’s possible there are no suitable markets within the target price range.

A less likely cause is that the current investment property is in a truly excellent market. There may not be a better market country-wide for the target price range.

However, there may be even less likely reasons. For example, the property market country-wide may be in the middle of the worst recession in Australian history. There may be very few markets with a future forecast of a positive net position within 3 years.

Without any alternative markets to choose from, it would seem obvious that the investor should hold. However, the property may be forecast to lose money over the next few years. It might actually be better for the investor to sell to stop further loss. The analysis of the report shifts from an opportunity cost vs. recycling costs focus, to one of forecasting future losses.

Negative sale proceeds Report

The “Negative Sale Proceeds” report will be presented in the case where the sale of the property would not release any funds to reinvest. In fact, there would be insufficient funds to balance accounts at settlement. In other words, the investor would not have the finances to sell.

At settlement, the investor needs to pay:

• Their lender

• Their selling agent

• Their legal aid (solicitor or conveyancer)

• Possibly even capital gains tax

If the sale price of the property is less than the combined sum of the above “exit” costs, then the owner will not

be able to balance cheques and settle.

This is quite often accompanied by an even worse scenario – negative equity. Negative equity occurs

when the loan size exceeds the value of the property. It’s possible to have positive equity yet negative sale proceeds. Remember that there will be

an agent’s commission to pay and legal fees. Negative equity results in the same kind of report, it is just a worse case of negative sale proceeds.

The only way a sale can proceed in this case is if the investor contributes extra funds to pay for the settlement shortfall. But would it be worth it? Why pay more money to lose an asset? Again, this case seems obvious – hold.

However, if the property is forecast to lose

a significant amount of value and is heavily negatively geared, it may be a better decision to sell and stop further loss.

Doesn't answer your question? Just email info@sellorhold.com.au and we will get back to you as soon as possible.

Please note that our support staff cannot provide tax, financial or investment advice. We strongly encourage you to seek advice from a qualified tax professional, financial advisor or property investment advisor.